Introducing Piggie - a brand new financial management app for the new generation. With a finance background and having been managing my money since my first paycheck in high school, I’ve always believed that good budgeting can pay off big in the future. However, many people struggle to learn or know how to even begin this process, especially the younger generation, so I thought of a simple idea:

Using generative AI technology to help set savings goals, budget ratios, and give financial advice, it gives people the boost of confidence and support they need as they develop financial literacy

research

Currently, the average American has gotten substantially poorer as economic imbalance becomes more serious, and the younger generations are bearing the brunt of the weight. Studies and polls have concluded that generation Z and Y are among the least confident in their financial literacy, and as schooling becomes more expensive and less achievable, opportunities for education become harder to come by

Problem

To understand the market and identify opportunities, as well as the pain points of prospective users, we’ve settled for 2 research methods:

Research

Competitive Analysis

User Interviews

Competitive Analysis

Strengths

comprehensive financials, as well as credit score reporting

integrates multiple bank accounts

Weaknesses

advertisements and pop-ups

sync issues and limited customization

Strengths

budgeting and savings features

community support and educational resources

Weaknesses

difficult interface - hard to learn

lack of investment tracking

Strengths

simple, easy-to-learn interface

automatically categorizes expenses in accounts

Weaknesses

need manual editing and entry

limited customization

After analyzing competitors and seeing the context of the market, I conducted interviews with 5 people of various ages, backgrounds, and levels of financial literacy

User Interviews

Key questions include asking about personal experiences and preferences with:

How they manage and budget their income and expenses

Their confidence in their financial literacy

Lessons they wish they learned earlier

Tools they use to manage their daily income and expenses

Research Takeaways + Insights

The financial habits of people vary from meticulous to carefree, but the majority of people have a core goal they base their financial planning on, whether it’s a big purchase or a savings number they want to achieve

Young adults view financial literacy as the gateway to long-term financial independence, and most of them want to learn more, including about topics like taxes and investments

Many people have tried financial apps but ultimately move from them, due to meticulous data entry, integration that isn’t seamless, or just lack of motivation

The top features that people look for in a financial app are seamless integration of all accounts, a more understandable interface, and automatic budget breakdowns and calculations

analysis

Personas

As a user, I need a more simple and accurate way to overview all my finances, so I can stay up-to-date on my finance status and make better choices

As a user, I need a more interactive way of setting financial goals, so I can spend less time doing menial tasks and improve my financial literacy

POV

How might we develop a way to summarize information for our users so they will be able to easily see and understand their financial situation?

How might we empower users to easily track their financial progress in a way that motivates and sustains their engagement with the program?

How might we develop an education program for our users so they will be able to utilize these resources to further their financial literacy?

HMVs

Based on market research and user interviews, we’ve determined that a viable solution to helping the next generation learn and grow their financial literacy is an app that integrates a user’s bank accounts, and uses generative AI to help suggest spending budgets based on habits and savings goals

Solution

ideation

In order to organize the ideas before designing the wireframes, a ranking was made to help prioritize which features we would include in the MVP

Feature Set Prioritization

Integration of 3rd Party Accounts

Alert Notifications (for Overspending or Unusual Behavior)

Gen AI Expense Categorization and Analysis

Budget Ratios

Savings Goals

Investments Tracking

Educational Resources

Credit Score

Debt Tracking

Paid-Subscription Model

3rd Party Collaborations

Personal Financial Advisors

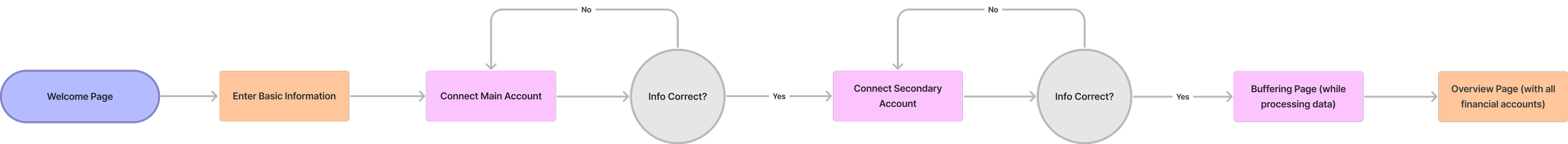

Task Flows

#1: Introduction to Piggie

Users start at the landing page, then entering contact and financial information, then arriving at the homepage

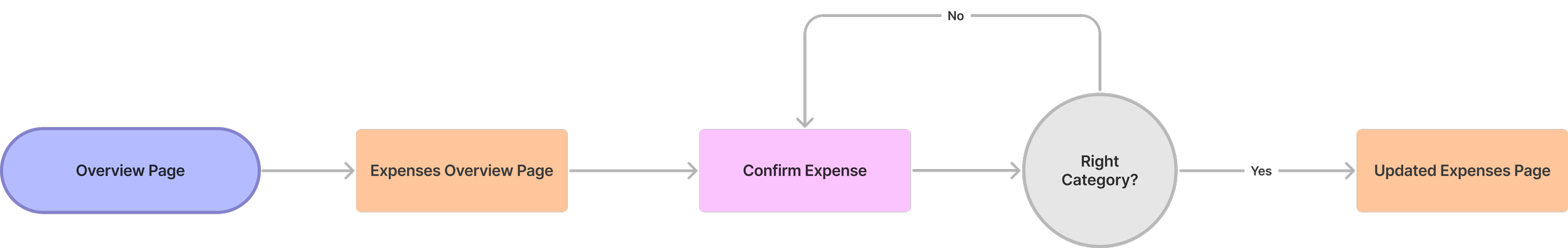

#2: Checking Your Expenses and Categorization

Users start at the overview page and head to the expenses page, where they can confirm their latest expense

early wireframes

User Flow 1: Onboarding process and account integration

landing page with logo

signing up for an account

adding bank account information for integration

option to add addition financial accounts

homepage, with summary of all financial accounts

User Flow 2: Checking expenses and tracking savings goals

home page

clicking the expenses page will bring you to an overview of all your expenses for the month

you can edit your expenses and check your progress

with GenAI, Piggie can recalculate your expenses and give you suggestions for spending your money wisely

see an updated expenses page with new goals

testing

This test will be conducted by 5 participants, and they will be selected from the previous group of interviewees in the research phase so they will be familiar with the project and objective

Test Plan

Objectives

Observe efficiency in completing tasks

Observe how users navigate the design

Evaluate ease of use

Identify problems for revision

What is Success?

Users don’t need additional hints to complete the task

Users can complete the task in a timely manner with little or no errors

Overall rating out of 5, for ease of use and design

Results + Key Takeaways

Many users were concerned about entering bank account information in a new app, even with the privacy policy

Users mentioned that this test with wireframes doesn’t really demonstrate the abilities of this app, because they only sign up for an account and check expenses. So we added more robust user flows in the next iteration

Many notes say the overall layout of the app looks hard-to-use, and the lack of branding makes it hard to appreciate. The bareness of the early wireframes made it more confusing

Iteration

In our next iteration, we’ve decided to focus on these key points:

Building more robust user flows, such as adding a savings goal and letting the generative AI feature suggest spending plans

Testing again with more built-out wireframes to avoid confusion

Cleaner and simpler feature layout, to make navigation more intuitive

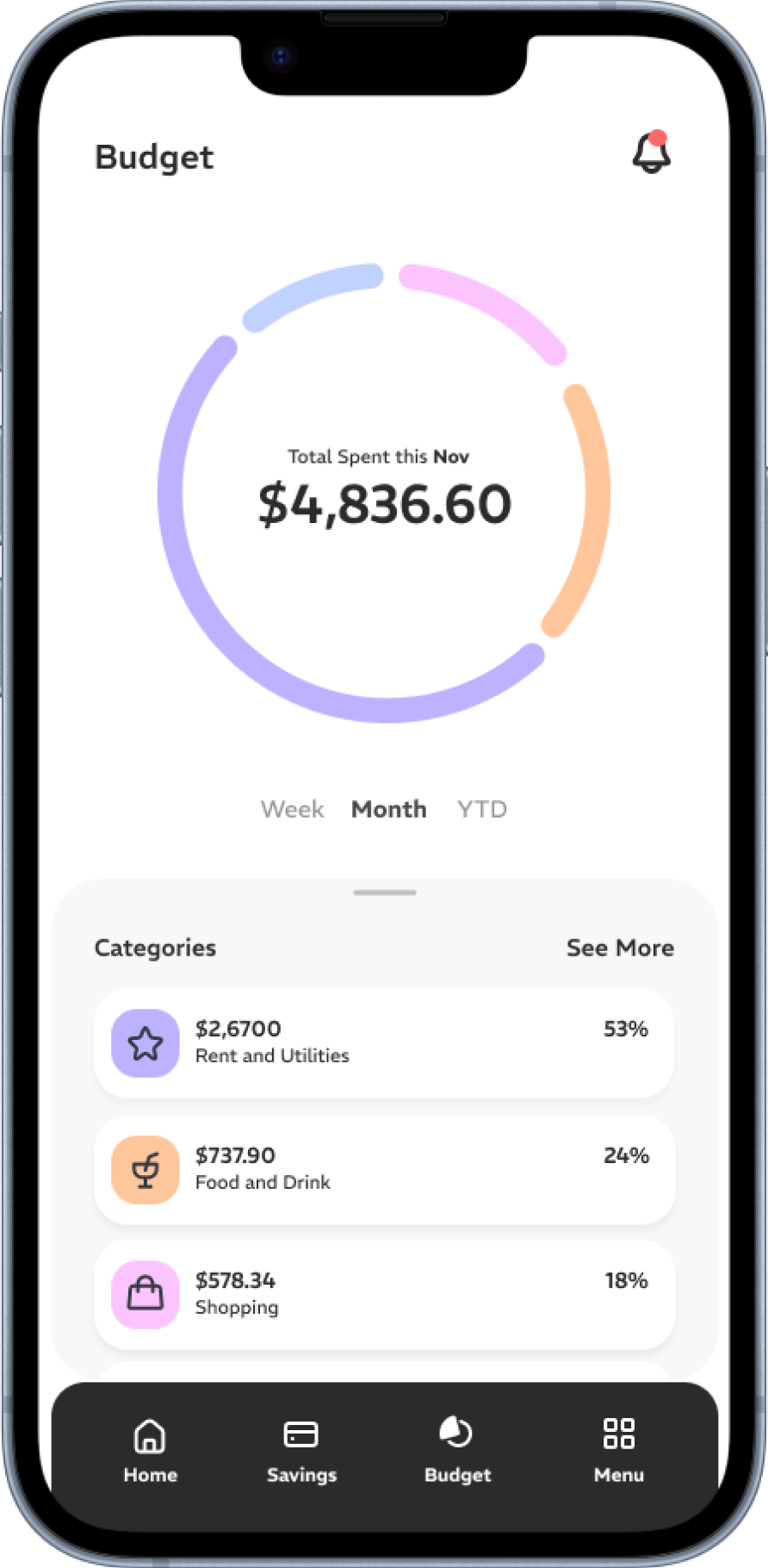

final product

Introducing

The next-generation financial app designed for the next generation, helping them learn more about the financial world and reach their goals one dollar at a time

See where all your money is in one place

Welcome to the future of financial management! Integrate all your bank accounts seamlessly and keep track of all your activity in one place. Track your expenses, savings, and investments in detail learn how to make your money work for you

Let Gen AI help you reach your goals

Saving for your next vacation? Add a goal and have our Gen AI program calculate how much you need to save, as well as how it’ll affect your spending. It can also calculate budget ratios for you, so you can spend money without worrying about breaking the bank!